June 2022 Market Update

Written on June 21, 2022 by Nick WardSolid information about our local market is helpful for everyone, and especially for our clients who are thinking about entering a real estate transaction this year. This update is based upon information supplied by the Champaign County Association of REALTORS Multiple Listing Service for all attached and detached single-family properties in Champaign, Savoy or Urbana. It is important to keep in mind that specific segments of the market may have performed better or worse than the overall market analyzed below.

Comparing the Last 12 Months with the Previous 12 Months

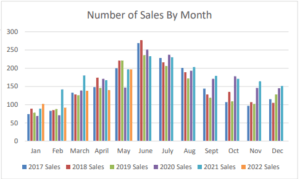

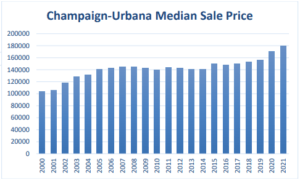

For the most recent twelve months (06/01/2021-5/31/2022) the MLS reported 2,080 sales with a median sale price of $184,102 and a reported average marketing time of 34 days. For the prior twelve months (06/01/2020-5/31/2021) the MLS reported 2,053 sales with a median sale price of $175,000 and a reported average marketing time of 73 days. This shows an increase in the number of sales of 27 homes or 1.3%. The median sale prices saw a 5.2% increase. There are currently 157 homes on the market with an average marketing time of 89 days. This results in a 0.9-month supply of homes in inventory, which is a significant shortage relative to historical supply demand relationships in this market. Most notably, the first quarter of 2022 saw sales volume return to more average levels, with April 2022 having the lowest number of sales in the prior 5 years. This is highlighted in the graph below. Additionally, we are seeing even shorter marketing times as the velocity of the market continues to be very strong.

The Interest Rate Story:

For most of 2017, 30-year fixed rate mortgages were available from 3.75% to 4.125%. Interest rates increased rapidly in January and February of 2018 and had remained relatively stable within the range of 4.5% to 4.75%. In September 2018, rates moved as high as 5% before starting to decline as the year ended. In 2020, rates varied from 3.5% to 3.6% through March. During the peak of the Covid-19 pandemic the Federal Reserve cut the interest rate, which resulted in more volatile interest rants that fluctuated within the 2.5% to 3.5% range. Since then, interest rates have begun to slowing increase, with more significant increases in the first quarter of 2022. Currently, 30-year fixed rate mortgage financing is available at 6.0%. Many experts are projecting interest rates to continue to increase over the coming 6 months. Please note that the interest rate can vary significantly between lending institutions and borrower qualifications. Contact your Joel Ward Homes agent for recommendations!

Local Employment Analysis

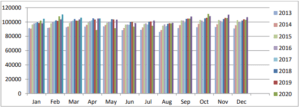

The close connection between employment levels and the strength of housing markets has been well established, both locally and on a national basis. In April 2022 (the last month for which data has been published) there were 109,302 employed people in Champaign County and an unemployment rate of 4.1 % In April 2021 there were 110,271 people employed with an unemployment rate of 5.0%. This results in a 0.8% decrease in the number of people employed. The current rate of unemployment is consistent with the rates since prior to the Covid-19 pandemic.

What follows is a graph showing the number of jobs in Champaign County, by month, based upon non-seasonally adjusted U.S Bureau of Labor Statistics data.

NUMBER OF JOBS IN CHAMPAIGN COUNTY NON-SEASONALLY ADJUSTED DATE PER BLS

Conclusions

It is most notable that there is a significant shortage of homes in inventory, which is putting upward pressure on sales prices. It is also significant that sales volume is returning to pre Covid-19 levels, though sales prices are still up significantly year-over-year. This could be a potential indicator of the market moving closer to a state of balance as higher interest rates push some buyers out of the market.

What does this mean to the home seller? We are still seeing atypically short marketing times and high sales prices. The shortage of homes available, combined with increasing trend of interest rates are continuing to push sale prices upward. We are starting to see this stabilize as interest rates increase, but it is currently an excellent time to sell for top dollar. Contact your Joel Ward Homes REALTOR for the best options!

For buyers, the primary concern is the rising interest rates. Rates have currently increased over one percentage point from 4% to 6.0% since the end of 2021 and are projected to continue to increase. This makes it important for buyers to move quickly and lock in long-term financing to offset risks posed by inflation and increasing interest rates. The current supply of homes in inventory is exceedingly low, which is likely going to make it more difficult to find suitable housing. Buyers in most market segments should be prepared for multiple-offer situations and offers above list price. This makes it even more important for your REALTOR to stay current on all homes which are listed for sale and meet your criteria.

Overall, Champaign-Urbana real estate has proven to be a good investment over time with an average annual appreciation rate of 2.6% since 2000, and this includes the 2009-2013 financial

crisis and recession. Remember that each particular segment of the market is different. If you are thinking about selling your home, or buying one, the best decision is to contact your Joel Ward Homes REALTOR to obtain current information about the specific segment of the market relevant to your property.