August 2022 Market Update

Written on August 5, 2022 by Nick WardSolid information about our local market is helpful for everyone, and especially for our clients who are thinking about entering a real estate transaction this year.

This update is based upon information supplied by the Champaign County Association of REALTORS Multiple Listing Service for all attached and detached single-family properties in Champaign, Savoy or Urbana. It is important to keep in mind that specific segments of the market may have performed better or worse than the overall market analyzed below.

Comparing the Last 12 Months with the Previous 12 Months

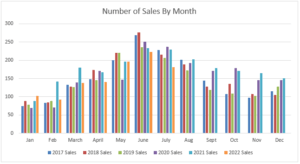

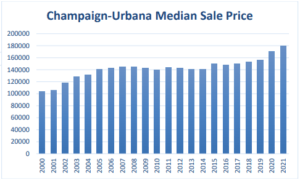

For the most recent twelve months (08/01/2021-7/31/2022) the MLS reported 2,036 sales with a median sale price of $187,000 and a reported average marketing time of 32 days. For the prior twelve months (07/01/2020-6/30/2021) the MLS reported 2,069 sales with a median sale price of $176,000 and a reported average marketing time of 60 days.

This shows a decrease in the number of sales of 33 homes or -1.6%. The median sale prices saw a 6.3% increase. There are currently 211 homes on the market with an average marketing time of 69 days. This results in a 1.2-month supply of homes in inventory, which is a significant shortage relative to historical supply demand relationships in this market.

Most notably, July 2022 saw the lowest sales volume in the prior 5 years. Additionally, month-over-month Champaign-Urbana saw a 3.6% decline in median sales prices ($216,000 in July and $224,000 in June). However, please note that year-over-year median sales price increases are still above average at 6.3%.

Interest Rates

The Interest Rate Story: In 2020, rates varied from 3.5% to 3.6% through March. During the peak of the Covid-19 pandemic the Federal Reserve cut the interest rate, which resulted in more volatile interest rants that fluctuated within the 2.0% to 3.5% range. In the first quarter of 2022 we saw a sharp increase in interest rates, peaking in early July around 6.3%.

Currently, 30-year fixed rate mortgage financing is available at 5.0%. Many experts are projecting interest rates to stabilize in the range of 5%-7% over the coming years while inflation slows. Please note that the interest rate can vary significantly between lending institutions and borrower qualifications. Contact your Joel Ward Homes agent for recommendations!

Local Employment Analysis

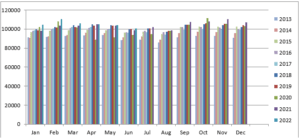

The close connection between employment levels and the strength of housing markets has been well established, both locally and on a national basis. In June 2022 (the last month for which data has been published) there were 100,606 employed people in Champaign County and an unemployment rate of 4.3% In June 2021 there were 98,587 people employed with an unemployment rate of 5.8%. This results in a 2.0% increase in the number of people employed. The current rate of unemployment is consistent with the rates since prior to the Covid-19 pandemic.

What follows is a graph showing the number of jobs in Champaign County, by month, based upon non-seasonally adjusted U.S Bureau of Labor Statistics data

NUMBER OF JOBS IN CHAMPAIGN COUNTY NON-SEASONALLY ADJUSTED DATE PER BLS

Conclusions

It is most notable that there is a significant shortage of homes in inventory, which is putting upward pressure on sales prices. It is also significant that sales volume is returning to pre Covid-19 levels, though sales prices are still up significantly year-over-year. This could be a potential indicator of the market moving closer to a state of balance as higher interest rates push some buyers out of the market.

What does this mean to the home seller? We are continuing to see atypically short marketing times when compared to the 5-year average of 90 days on the market, which is consistent to the continued shortage of homes in inventory. However, we are now seeing signs of the market returning to more of an equilibrium as less buyers enter the market. Competitive pricing and strong marketing will become increasingly important as buyers begin to have more options.

For buyers, the market is beginning to show signs that are in the buyer’s favor following two years of an extremely strong seller’s market. We have also seen interest rates being to stabilize following the significant increases in the first and second quarters of 2022. Overall, the buyer’s side of this story appears to be in improving.

Overall, Champaign-Urbana real estate has proven to be a good investment over time with an average annual appreciation rate of 2.6% since 2000, and this includes the 2009-2013 financial crisis and recession.

Remember that each particular segment of the market is different. If you are thinking about selling your home, or buying one, the best decision is to contact your Joel Ward Homes REALTOR to obtain current information about the specific segment of the market relevant to your property.