August 2023 Market Update

Written on August 9, 2024 by Nick WardThis update is based upon information supplied by the Champaign County Association of REALTORS Multiple Listing Service for all attached and detached single-family properties in Champaign, Savoy or Urbana. It is important to keep in mind that specific segments of the market may have performed better or worse than the overall market analyzed below.

Year over year Analysis

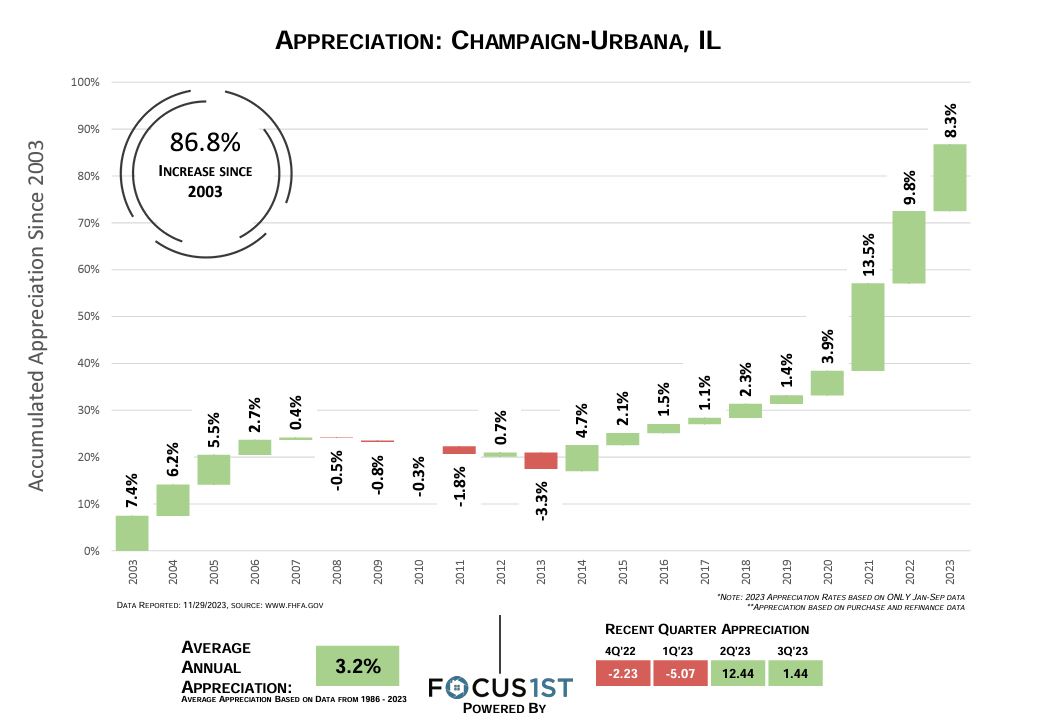

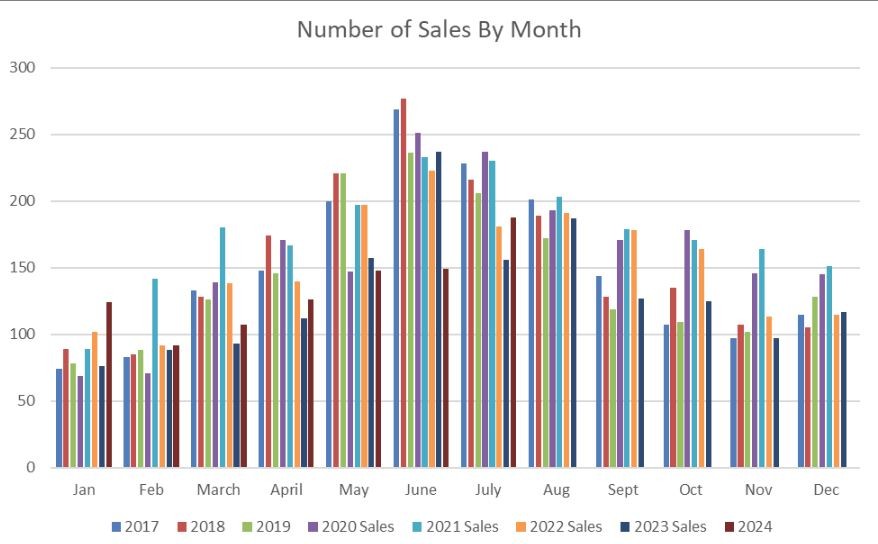

For the most recent twelve months (08/01/2023-7/31/2024) the MLS reported 1,586 sales with a median sale price of $222,250 and a reported average marketing time of 29 days. For the prior twelve months (08/01/2022-7/31/2023) the MLS reported 1,741 sales with a median sale price of $198,000 and a reported average marketing time of 31 days.

This shows a decrease in the number of sales of 155 homes or -8.9%. The median sale prices saw a 12.2% increase year-over-year. There are currently 184 homes on the market with an average marketing time of 88 days. This results in a 1.4-month supply of homes in inventory, which is a significant shortage relative to historical supply demand relationships in this market. Please note that the average marketing time of active listings is significantly above the average for closed sales in the prior 12 months.

Interest Rates

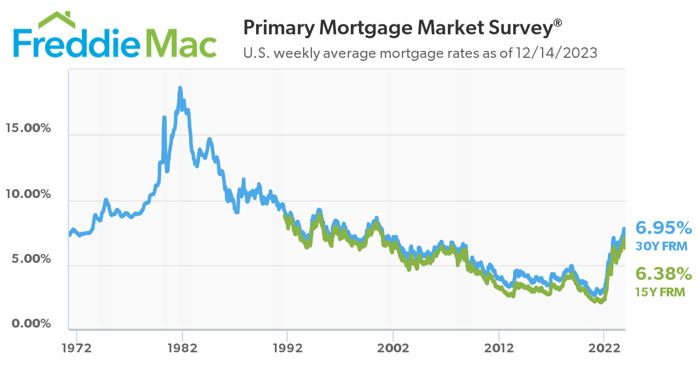

In 2020, rates varied from 3.5% to 3.6% through March. During the peak of the Covid-19 pandemic the Federal Reserve cut the interest rate, which resulted in more volatile interest rants that fluctuated within the 2.0% to 3.5% range. In the first quarter of 2022 we saw a sharp increase in interest rates. Interest rates peaked in our area around 8.25% in summer of 2023, and have since come down and fluctuate between 6.75% and 7.75%.

With the Federal Reserve reporting a half a percentage point cut in rates in September we have seen mortgage rates marginally decline in recent weeks. Please note that the interest rate can vary significantly between lending institutions and borrower qualifications. Contact your Joel Ward Homes agent for recommendations!

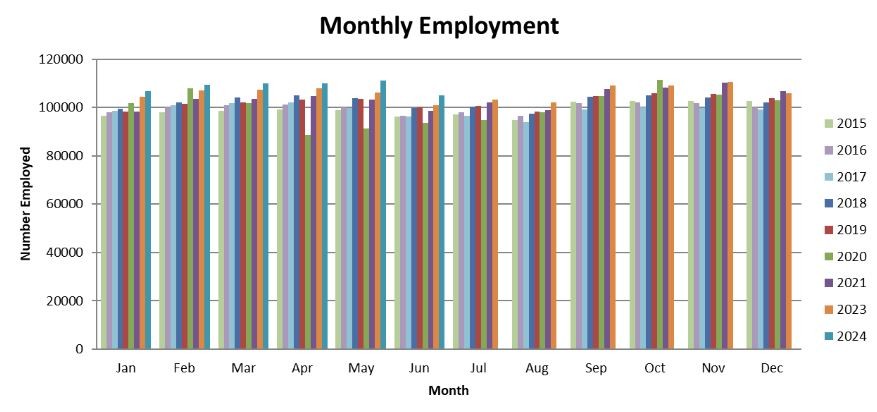

Employment

The close connection between employment levels and the strength of housing markets has been well established, both locally and on a national basis. In June 2024 (the last month for which data has been published) there were 105,126 employed people in Champaign County and an unemployment rate of 5.4%. In June 2023 there were 100,966 people employed with an unemployment rate of 4.7%. This results in a 4.1% increase in the number of people employed. What follows is a graph showing the number of jobs in Champaign County, by month, based upon non-seasonally adjusted U.S Bureau of Labor Statistics data.

Conclusions

The most significant change to the market is the day on market for active listings is increasing significantly when compared to recent months. While this is typical for early fall market, as well as election years, it does mark a change. The Federal Reserve’s recent announcement of plans to decrease interest rates in September could also be a contributing factor to the slow down in the current real estate inventory.

What does this mean to the home seller? It is becoming increasingly important for sellers to position their property in the absolute best possible way. This is not only true for price, but condition as well as buyers are seeing more options to choose from. While the shortage of supply is still a significant factor, we have seen the supply increase by 0.6 months over the summer marketing season.

While buyers should still be prepared to handle a multiple-offer situation we are experiencing more situations where buyers are able to negotiate, rather than putting in a “highest and best” offer, especially at price points above $300,000. Decreasing interest rates will also significantly help buying power, though they could also release some pent-up demand.